Mortgage Blog

Getting you the mortgage you deserve and need

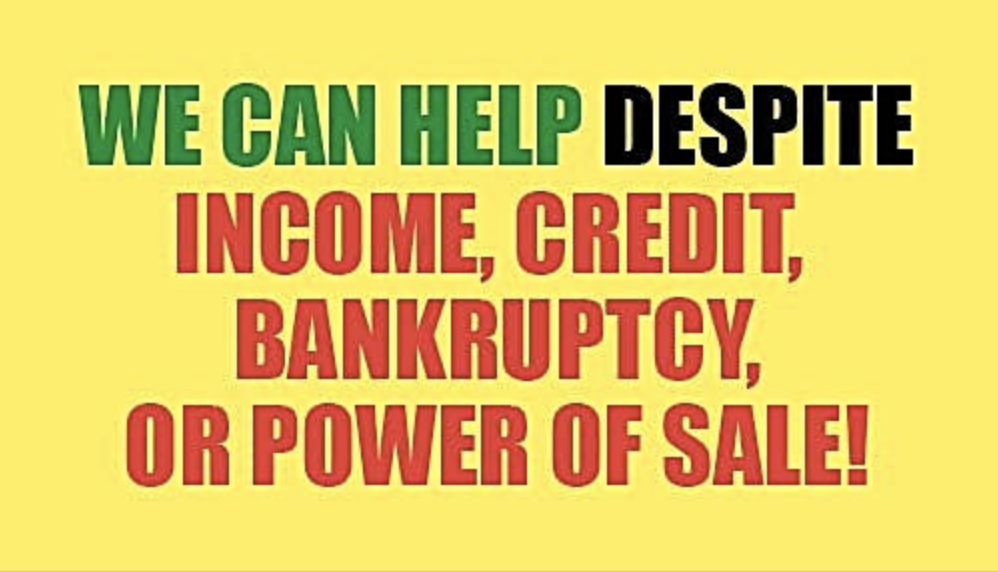

TATIANA NAZAROVA OFFERS 'SWEET MORTGAGE DEALS' TO EVERYONE REFINANCING OR PURCHASING A NEW HOME

March 11, 2024 | Posted by: Tatiana Nazarova

Before you start shopping for a new home, you'll need to know exactly how much house you can afford. Otherwise, you could end up in a home that is way out of your budget. What you qualify for may not be what you can actually afford, based on your personal situation. Only you can decide how much you're comfortable paying every month.

How Much Home Can You Afford?

While you may be tempted to spend the full amount of mortgage you're approved for, you should take your total expenses into consideration. When deciding how much to spend on a home, remember: your decision should be based on:

. Your current expenses - Even if your mortgage amount is under 40 percent of your total debt, you may have other expenses not taken into consideration by the lender or the bank. Take into account your down payment, closing costs, monthly debt payments, and other living costs - such as groceries, transportation, and dining out.

. Your future expenses - If your financial situation changes in the future, will you still be able to afford your home? Your pre-approval is based on your current income and debt levels. Consider whether you'll still be able to pay your monthly mortgage if you lose your job or take on more expenses.

. Your lifestyle - Take a look at your current budget. Are you going to have to make cutbacks or changes to your current lifestyle in order to live comfortably with the mortgage amount? Decide what parts - if any - of your lifestyle you're willing to sacrifice. You may decide giving up certain aspects of your lifestyle are worth getting into a 'better' home. On the other hand, you may feel happier spending less on a home if you can maintain other aspects of your lifestyle. Figure out your priorities, and go from there.

How is Your Mortgage Amount Determined By the Lender?

When you go to a bank or lender for a mortgage pre-approval, you'll receive a quote for the maximum amount you can borrow. Banks and lenders use specific calculations - called mortgage ratios - to determine what you can afford based on your overall monthly debts, including housing costs. These ratios are:

. Gross Debt Service (GDS) Ratio - Your mortgage expenses (principal, interest, utility costs, condominium maintenance fees, and property tax) should represent no more than 32 percent of your gross annual income.

. Total Debt Service (TDS) Ratio - The gross annual income needed for all debt, including housing costs, personal and car loans, and credit cards. Your total debt should not exceed 40 percent of your gross annual income.

Don't feel pressured to spend the full mortgage amount you've been approved for. Once you've considered the above factors, you'll have a better idea of how much money you should spend on a home.

I am Tatiana Nazarova, the Mortgage Matchmaker, and licensed Mortgage Agent with Pineapple Financial Inc. (Pineapple Mortgage) – Licenses BCFSA MB600871/AMF 3002803823/ RECA 00424723, a successful, reputable, and licensed Mortgage Group firm in Canada. We have been successful in arranging attractive mortgages on homes and/or condos already purchased and/or about to be purchased for many years and over 2 billion dollars funded each year. Plus, I have my own private lenders with excellent rates and terms.

- Residential Mortgages,

- Construction Finance,

- Private Lending,

- Mortgage Renewal,

- Cash back Mortgages,

- Mortgage Refinance,

- 1st Mortgages,

- 2nd Mortgages,

- Home Equity Takeout,

- Home Equity Line of Credit,

- New Immigrant,

- Bankrupt.

* I am a Chartered Accountant and Economist for over 30 years & have been in the Financial Profession and Industry since 2002. I enjoy utilizing my education and skills to assist others to help them with purchasing a home and financing the perfect match. My passion is helping people achieve their goals. As each client is different, it is my job to listen and help my clients find the correct match of a mortgage that suits their needs.

** I educate each of my clients on how they can structure their financial situation to reach their mortgage financing goals.

*** Placing them with the right lender is part of a financial strategy from the best interest rates to getting a mortgage with the best terms and appropriate pre-payment penalties.

**** For a Free Mortgage Quote, information and clarification contact me at your convenience and my Mortgage Team will begin to work for you and create the perfect match;

Signal: +1 (647) 234-9529

What’s App in Canada: +1 (647) 234-9529

Telegram: +1 (647) 234-9529

e-Mail: Tatiana@TatianaNazarova.ca

e-Mail: tatiananazarova@gopineapple.com

e-Mail info@tatiananazarova.ca

Website: https://www.tatiananazarova.ca

https://gopineapple.ca/tatiananazarova

Sincere regards.

Tatiana Nazarova CPA., MBA., BA(Econ)

Mortgage Agent - Licence Number: M22001630